One of the concerns about the resumption of student loan payments is that it could tank the U.S. economy. Paying back student loans may cause consumers to reduce spending to the point of causing another recession.

About 43.4 million Americans have federal student loans, collectively amounting to $1.63 trillion of debt, according to the National Student Loan Data.

According to the Federal Reserve Bank of New York data, student loan debt accounted for roughly 11% of total household debt, up from only 3% in 2003.

These figures may seem like a lot, but they are not large enough to cause a significant slowdown in GDP. Oxford Economics estimates the resumption of student loan payments will subtract 0.1% from GDP in 2023 and 0.3% in 2024. Other economists estimate similar cuts as well.

Why Student Loan Repayments Won’t Cause A Recession

The last time I had student loans was between 2003-2007. I took out about $40,000 in student loans to attend business school part-time at Berkeley (graduated in 2006). The average interest rate was about 4.5%.

Even though my company paid for 80+% of my school’s tuition, I still took out student loans as a way to boost my liquidity and invest. I don’t recommend doing this unless you are a seasoned investor.

Luckily, the stock market did well until it imploded in 2008. But by then, I had already paid back all of my student loans.

Based on my student loan debt history, I’m sixteen years removed from the process. Therefore, I had a blind spot about student loan repayments which was revealed to me after a discussion with another parent.

Here are four reasons why student loan repayments won’t cause another recession.

1) Borrowers have been paying back their student debt

I spoke to a parent who went to medical school and is now a doctor. We talked about potentially buying west side real estate in San Francisco given that’s where I think the greatest opportunity lies. He said he isn’t be able to buy property just yet because he’s still working his way through student debt.

When I told him how great it must have been to have their student debt payment paused, he mentioned he and his wife have continued paying down their debt during the entire time!

Ah hah! Blind spot. I had assumed all student debt holders stopped repaying their debt beginning in March 2020. Whereas in fact, a good percentage of the 43.4 million Americans with student loan debt continued with their repayments over the last 3.5+ years.

Given this is the case, the remaining payments and/or payment amounts may not be as large as many fear. After all, there was a 3.5+-year period where student loan interest declined to 0%. An individual’s student loan debt could only have gone up if they willingly took on more debt.

With 3.5+ years of debt repayment, student loan debt holders have less debt today.

2) Student loan borrowers saved and invested their extra cash flow

Economic theory states that we are all rational actors long-term. Therefore, all cash flow savings from not having to pay back student loans for 3.5 years were either saved or invested. This includes all the stimulus money as well.

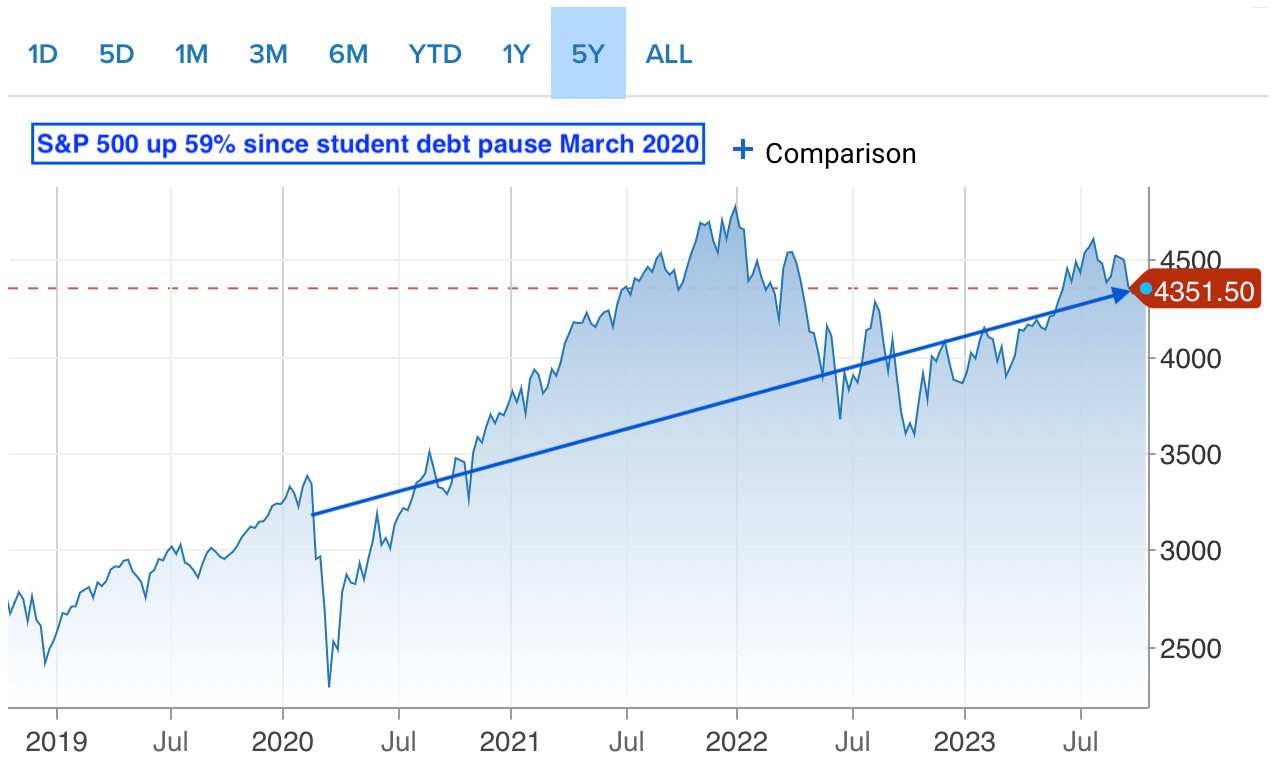

Since March 2020, the S&P 500 is up over 59% (2,700 to 4,300). If you invested in real estate, your property is also up between 10% – 60% un-leveraged. Therefore, student loan borrowers who saved and invested their student loan payments are wealthier today.

Student loan borrowers who saved and invested their extra cash flow can simply liquidate some of their investments to pay their student loans if they wish.

Of course, not every student loan borrower saved and invested their extra cash flow. Plenty of people used the extra cash flow to pay for necessities or wants. But this is also an economically rational move. These people deemed non-investment expenditure as more important than investment expenditure.

3) The SAVE repayment plan

The Biden-Harris administration launched the SAVE Payment plan that has canceled millions of loans worth billions of dollars.

From the report, “The Biden-Harris Administration estimates that over 20 million borrowers could benefit from the SAVE plan. Borrowers can sign up today by visiting StudentAid.gov/SAVE.”

Somehow, the Biden-Harris administration has been able to successfully cancel student loan debt despite the Supreme Court blocking Biden’s student loan forgiveness program in June 2023. Therefore, up to potentially half of all student borrowers may get further relief.

More government student debt relief through an income-driven repayment plan will soften the blow of debt repayment. As a result, consumer spending may not be negatively affected as much.

4) People are making more money and are wealthier 3.5 years later

Are you wealthier today and earning more money than you were in March 2020? Most people would say yes. Sure, inflation of goods and services has taken a large bite out of the consumer’s buying power. However, the majority of workers should at least be earning more today.

Look at all the strikes in Hollywood, the auto industry, the media industry, the education industry, the transportation industry, and more. Striking workers are hammering out deals for 20%+ pay increases.

UPS drivers are making $145,000 today but will making $170,000 by the end of 2028. Not bad!

Workers everywhere are getting paid more. With higher income and greater wealth, paying back existing student loan debt should be easier.

If You Are Struggling To Pay Back Student Debt

Unfortunately, all good things must come to an end. Getting a 3.5-year break with 0% interest and not having to pay was a nice gift. My hope is that most people took advantage by putting the extra cash flow to work.

For those who are struggling to resume paying back your student debt, here’s what I’d do.

First, go through your budget and cut out all non-necessities. Dinners out, unnecessary clothes, concert tickets, and vacations that require flying should all be eliminated. The pleasure you will experience from being 100% student debt free will outweigh the joy you receive from spending on indulgences.

Second, put yourself on a spend-less challenge. Make it a game to see how much less you can spend each month. Start with a 10% cut overall. Then keep on cutting by 10% every month until you can’t take it anymore. You may be surprised by how easily you can adapt. Use all savings toward paying down extra student debt.

Finally, take on a side hustle and use 100% of the income to pay down student debt. As soon as you tether a clear purpose for work, work becomes much more meaningful.

The one thing we can expect is more government support in the future if things get dire. However, I’d try to operate your finances as if support never comes. This way, you’ll be more disciplined with your finances. If support ever does come, the unanticipated help will feel like a big bonus.

Reader Questions And Suggestions

Do you think the resumption of student loan payments will tank the economy? If you have had student loans since March 2020, did you continue to pay back your loans during the 3.5-year break? Are your income and wealth higher today than it was since March 2020?

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

Here’s a related podcast episode on student debt, entitlement mentality, and valuing a college degree.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

About Author

You may also like

-

Key Factors To Consider Before Changing Health Insurance Plans

-

Return On Effort (ROE) Is Your Key To Unlocking A Better Life

-

A Net Worth Equal To 25X Expenses Is Not Enough To Retire Early

-

The 4% Rule: Clearing Up Misconceptions With Its Creator Bill Bengen

-

Uncover Your True Investment Risk Profile: It’s Not What You Think