If there’s one side hustle that’s generated the most buzz among Side Hustle Nation in the last few years, it would have to be becoming a loan signing agent.

Loan signing agents are mobile Notaries that help facilitate mortgage closings, and can earn $75-200 per appointment.

In this post, you’ll learn what it takes to start a mobile Notary business and get a better idea if Mark Wills’ Loan Signing System is right for you. Mark calls this “the best-kept secret in real estate” and is obviously a huge cheerleader for his program.

But does it really work?

Kristin Barker Stauffer, a Loan Signing System student in Phoenix, contributed this post. As a mother of 5, she’s earning around $900 a month with her mobile Notary side hustle. She invited readers to reach out to her via Facebook if you have any questions.

What is a Mobile Notary?

A Mobile Notary is a Notary Public who travels to your home or office to notarize a specific document or a set of documents.

These documents range from legal documents like Wills and Trusts, to car titles and home loan documents. A Mobile Notary verifies the signer’s identity, watches the signer sign the document, and then signs and stamps the document. It’s very simple, but very important work.

(I’d had documents notarized in the past, but never really knew why or what Notaries actually did besides put a big stamp on my paper.)

What Notaries Do

Let me first answer the question, “why do we need Notaries?”

The purpose of a Notary is to:

- Verify a person’s identity and to ensure they are who they say they are.

- Witness them sign the document(s) that needs to be notarized.

A Notary can be called to court if a document that Notary notarized is in question. The work of a Notary is very important and shouldn’t be taken lightly.

How Much Can You Make as a Mobile Notary Signing Agent?

As a mom of five children ages 4-12, my availability for loan signings is very limited.

With one child still at home, evening activities, and a husband that works full-time, I only do about 8-12 signings per month, and make about $900.

One of the perks of being a mobile notary is that there are signing appointments available all day, every day. It’s sometimes frustrating to not be able to accept those appointments because of my other responsibilities, but there are signing agents who do this full-time and make up to $15,000 per month.

Of course, other factors can impact your earnings as well, such as the size of your city and seasonality of the real estate market.

Still, there are Notary Loan Signing Agents all over the country working this business both a side hustle or a full-time profession.

One signing agent in my area is making an average of $8,000/month and she’s only in her third month of full-time business. She got started just over a year ago while working a full-time day job.

Meet an $8000 a Month Mobile Notary

In the video below, fellow Loan Signing System graduate Doug Hoyer shares how he built his mobile notary business to $8000 a month in around a year.

I highly recommend checking it out to hear first-hand what the business is really like.

What are the Requirements to Become a Mobile Notary?

The requirements for becoming a Mobile Notary vary from state to state. Since it wouldn’t make sense to detail out 50+ different sets of requirements here, I’ll let you Google that one on your own:

I’m in Arizona where getting your Notary Public Commission is super easy. For me, the process was:

- Download and complete the application from the Secretary of State website.

- Fill out the application and get it notarized. (job security, right??)

- Send in your application along with a $5,000 Bond ($25) and the application fee of $43.

The Secretary of State will then do a background check. If you pass, you’ll receive your Notary Commission in the mail within a few weeks.

In Arizona, we have a handbook that we review on our own to learn the laws, how to fill out the Notary Log Book, and more.

(Arizona also offers an in-person class once a week to help Notaries learn the laws and ins and outs of being a Notary Public.)

In other states, like California, those interested in becoming a Notary Public have to take a class, pass a test, and have fingerprints taken before they can receive their commission.

Again, before you sign up for Loan Signing System or any training program, double check the requirements in your state.

Mobile Notary Business Startup Costs

How much does it cost to start a mobile Notary business? Here are some of the most common startup expenses.

Getting Your Notary Commission

The costs involved in receiving your Notary Commission also vary from state to state. As mentioned above, it cost me $68 to become a Notary in Arizona ($43 for the application and $25 for the required $5,000).

The process was super inexpensive and took just a few weeks. I could have expedited my application for an additional $25, but instead used that processing time to study up on the loan signing documents (see below).

California on the other hand costs $40 for the exam and application and requires a $15,000 bond which costs $38, plus the expense and time of the above requirements.

Errors and Omissions Insurance

A minimum of $100,000 in Errors and Omissions Insurance coverage is required by most companies that Notaries work with, like title companies and signing services. This is super important because it protects you against mistakes and possible legal action.

In my state, this costs $104 per year. California’s E&O Insurance for the same policy limit is $156 per year. Other states are well under $100 per year, so be sure to check your state.

In any case, make sure to account for this insurance cost in your startup projections.

You can find more information at nationalnotary.org.

A Notary Stamp

This probably doesn’t come as a surprise, but you’ll also need a Notary Stamp. I purchased mine on Amazon for around $15.

The company you purchase from will send you an email and you reply with your Notary Commission certificate.

A Notary Journal

Most states require a Notary Journal costing $10-$15.

A Notary Journal is the physical log of your work. In it, you’ll record the:

- name, address, and identification information of the person signing the documents

- type of document you’re notarizing

- date of document

- date the document was notarized

- fee you received for the notarization

There are electronic journal options, but I haven’t used any of them yet.

A Laser Printer and Scanner

The most expensive piece of equipment you’ll need to get started is a laser printer with dual trays so that you can print legal and letter size documents. One with a scanner is preferred.

These range in price, but you only need a basic laser printer which you can buy for $250-400. If you don’t buy a printer with a built-in scanner, you’ll need to purchase a scanner separately.

I ended up purchasing a more expensive color laser printer with scanner so that I would only have one printer for my business and family.

Printer Paper

A small but important expense is paper. You’ll need to keep both legal and letter size paper on hand at all times. Shop around in your area and online to find the best prices.

I found that buying letter-sized paper by the case and legal by the ream works out for me, as most documents tend to use less legal paper.

A Bag or Briefcase

You will also need some sort of bag to carry your supplies and loan documents. My husband made a custom bag for me, but there are plenty of inexpensive options available and you may have a bag in your home already.

Just make sure it can hold everything you need while out on a signing, such as the documents, your stamp and log book, and a few pens.

National Notary Certification

Many companies you’ll work for will want you to be National Notary Association Certified. The fee is $65 a year, which includes a background check.

Optional (but recommended): A Training Program

And last but not least, the training program that really helped me get started was the Loan Signing System (LSS) Course.

Nick’s Notes: That’s my affiliate link; use promo code sidehustle for 10% off.

There are three options, ranging from $197 to $497, which I’ll cover in more detail below.

I know of other signing agents who’ve started without a course, but this was crucial for me. Even the National Notary Association recommends taking a training course:

All in, my total startup costs were about $800. This included everything I needed including getting your LSS certification as well as the printer and associated supplies.

In the video, Doug mentioned a similar initial investment in the $1000 range to get started.

Of course, this will vary based on the specific items you choose to purchase as well as your state.

About the Loan Signing System Course

The Loan Signing System Course is an amazing course to take to become a Notary Loan Signing Agent.

I can’t imagine walking into a loan signing as a Notary without having previously taken this course. I would be completely lost.

What’s Included in the Course?

This course takes you through each document you’ll find in typical:

- home loan purchases

- refinances

- HELOCs (home equity lines of credit)

- home sellers packages

- reverse mortgages

The Loan Signing System course includes a set of documents for you to print off and use during the training and to practice on your own. Mark Wills, the creator of the course, explains each document and takes you through an entire closing so that you can see exactly what he does in a signing.

How is the Course Structured?

The course is video-based with PDFs available to read and print for future reference.

The training also contains information about how to get signings once you become a Notary. This includes a list of reputable signing service companies, and how to get signings directly from loan officers and escrow officers.

The course is engaging, so you won’t get bored and fall asleep!

In some of the videos, Mark is doing a live training with a small group of people via a conference call format. I found this helpful as some of the attendees would ask questions allowing him to re-explain common questions and give clarity.

What’s the Most Helpful Part of Loan Signing System?

The entire course is incredibly helpful!

One of the added bonuses of this course is that he goes through an entire signing so that we can see just what he does at a signing. I am a visual and auditory learner, so seeing the documents and having them in my hand as well as watching Mark and hearing him do an entire signing really helped me grasp what I needed to do.

Funny story: I recently refinanced my home and we happened to have a Loan Signing System graduate do our loan signing! She did everything exactly as I do and as Mark taught in the course.

How Much Does the Loan Signing System Course Cost?

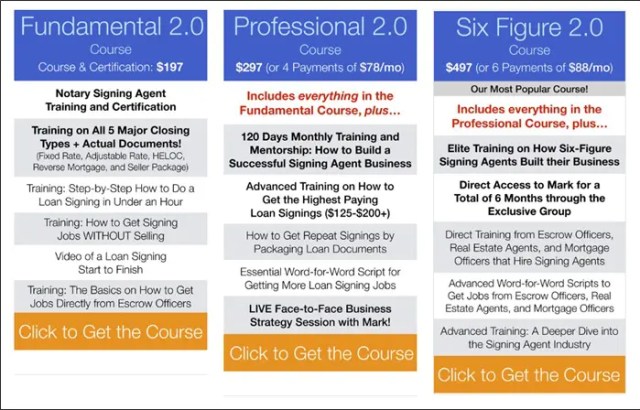

There are three pricing options (of course subject to change without notice) with the Loan Signing System Course:

- Fundamental: $197

- Professional: $297

- “Six Figure”: $497

Pro Tip: Use promo code sidehustle for 10% off.

All options include entry into a private Facebook group. This group is fantastic and is full of helpful Notaries that are all LSS certified.

I went with the $297 option, but I would purchase what you can afford. Payment plans are also available. With hard work you will be successful!

This is one training program where it literally only takes a handful of signings to re-coup your investment. Doug noted that it took him a couple months to breakeven on his startup costs.

What’s Disappointing or Over-Hyped About the Course?

The class is everything Mark says it is. One thing he says repeatedly is that you can make $75-200 per appointment, which is true, but that can be misunderstood as per hour because he also talks a lot about completing a signing in 45 minutes.

However, if you include your drive time, printing time, scanning docs for “scanbacks” (not always required), and a trip to FedEx/UPS or the title company to return the documents, then you’re at an hour and a half to two hours.

That comes out closer to $35-100 per hour. Still, not a bad hourly rate in my opinion.

The other thing to be aware of is whether you live in an “escrow state” or an “attorney state.” While not impossible, it can be harder to get loan signing agent gigs in attorney states. See below for more details.

Where DOESN’T This Work?

Becoming a mobile Notary loan signing agent is an awesome side hustle, but it doesn’t work well in every state. Here are some of the restrictions I found.

Attorney Requirements

Several states require an attorney to perform loan closings. So unless you’re already a lawyer, you may be out of luck if you live in one of these states.

Information from NationalNotary.org:

- Connecticut – Prohibits out of state attorneys and nonattorney Notaries from conducting closings for most mortgage loans in Connecticut. This excludes home equity lines of credit or other loans secured by real property that do not require the issuance of a title insurance policy.

- Delaware – Requires an attorney admitted to the state bar to be present or involved in the closing of real property transactions.

- Georgia – Requires an attorney admitted to the state bar to be present or involved in the closing of real property transactions.

- Massachusetts – Requires an attorney admitted to the state bar to be present or involved in the closing of real property transactions. A Notary who is employed by a lender may notarize a document in conjunction with the closing of his or her employer’s real estate loans.

- New York – Certain companies providing assignments to signing professionals may choose to only utilize licensed attorneys.

- South Carolina – Requires an attorney admitted to the state bar to be present or involved in the closing of real property transactions.

- South Dakota – Authorities conflict about whether Notary Signing Agents can conduct signings without being an attorney.

- Texas – HELOC loans must be signed and closed in the office of a lender, attorney, or title company.

- Vermont – Requires an attorney admitted to the state bar to be present or involved in the closing of real property transactions.

- West Virginia – Requires an attorney admitted to the state bar to be present or involved in the closing of real property transactions.

According to Loan Signing System, the following states are also “Attorney States,” meaning an attorney may have to perform loan closings:

- Alabama

- Hawaii

- Iowa

- Kentucky

- Maine

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Rhode Island

- Tennessee

- Virginia

Mark’s advice if you live in one of these states is to check how loan closings typically go down. “Check with your Secretary of State, local attorneys, and your personal counsel to be sure how signings are handled,” Mark says. “It’s possible that you could still assist in the process.”

Limited Fees

Other states restrict how much a mobile Notary can make. For example:

- Indiana – “Notaries can charge $10.00 per notarization.”

- Nebraska – “The allowable fee for taking acknowledgement of deeds or other instruments is $5.00.”

- Nevada – Notaries can charge $5 for taking an acknowledgement and $2.50 for each additional signer. The state does allow you to charge travel fees.

- North Carolina – Limits the fees Notaries may charge (to the statutory maximum fees for notarial acts). No other ancillary fees may be charged.

Other State-Specific Restrictions to Be Aware Of

- Indiana – Requires a title insurance license for all closings.

- Maryland – Requires a title insurance license for all closings.

- Minnesota – Requires a closing agent license.

- Virginia – Restricts Notaries from conducting real property signings without an escrow license if they but once handle monies for closing costs.

Of course these rules and regulations are subject to change at any time, so please be sure to do your own due diligence!

Other Loan Signing System Mobile Notary Success Stories

Nick here again. Aside from Doug (in Washington state) and Kristin (in Arizona), I’ve heard from a few other LSS students having success with the program.

First, Brian Schooley, a father of 5, shared his story on The Side Hustle Show podcast. When we recorded in 2018, he was earning $1500 a month, but he occasionally sends me updates via messenger on his progress:

And this one from late 2019 at $6000 in a single month:

You can download the episode with Brian or tune in here:

We also heard from PJ Edwards of Texas in episode 300 of The Side Hustle Show. She was inspired by Brian’s story and said to herself, “Well go ahead, what do I have to lose?”

She went online to the Texas state website and submitted an application to be a notary. It cost $85, and she also paid around $200 for 4 years of liability insurance, and then started working through the Loan Signing System course.

PJ signed up for the signing services given in the course and approached title officers and loan companies to get on their books. Shortly after, she started getting assignments sent to her via text and email.

The first person to respond gets the signing gig, so PJ keeps her phone on her and is quick to respond during the day. When we spoke, she’d done 7 signings that paid between $40-$150 each and had another 5 lined up for the following week.

Occasionally Mark sends me testimonials from other students who heard about this through Side Hustle Nation:

Do You Need to Take a Course Like Loan Signing System?

Of course not! There’s always a way to figure things out on your own. I view courses as a way to shortcut your learning curve — and that shortcut and mentorship is what you’re paying for.

William, a Side Hustle Nation member in Florida, described his experience:

“I’ve been a mobile notary in Florida for over a year. I recently relocated to an area with tons and tons of construction, and was looking for a way to capitalize on this. Loan closings caught my attention.

“I did listen to episode 286 when I was researching the gig, but didn’t take the course. In Florida, you have to take a free course to get your actual notary certification. That part is easy.

“I took the National Notary Association exam to be NNA-certified for Loan Closings (the only certification that seems to matter). I failed the test the first time, but passed the second time. There’s no extra fee for the retake.

“I looked over all of the information I could so I could talk the talk and start looking for gigs. I’ve since done work at multiple levels.”

What are Mobile Notary Loan Signing Appointments Like?

Most of the appointments I do are in borrowers’ homes. Before an appointment, I call the client to confirm the time and location.

Then I print the documents, which I usually received through a platform like SnapDocs. You have to make two sets; one copy to sign and one for the borrower to keep for their records.

When I arrive at the home, everyone has been very welcoming. Most offer me water and we sit down at the kitchen or dining room table.

I get everything I need out of my bag and we get started. I take gentle control of the appointment by asking for their form of ID, and I tell them to sign all of the documents consistently and to make sure dates are clear.

As we go through the stack of paperwork, I briefly explain each document and confirm the necessary information is correct. This includes the interest rate, loan amount, term, address, etc.

I try to keep things light and add a little humor since signing all the documents can get a little boring. Taking the edge off signing a very large loan puts people at ease. Some clients are talkative and we start talking about all kinds of things, while others stick right to business.

Though most appointments have no problems, occasionally there are mistakes or we have a question. This requires a phone call to the escrow officer or another contact. Generally though, appointments are straightforward, streamlined, and done in 45 minutes.

How Do You Get Mobile Notary Signings?

There are two ways to get signings: through signing services, or through industry relationships.

Through Signing Services

The first way is through signing services. These are like big databases of signing agents that title companies use to find notaries. The signing service will take a cut of the total signing fee and the notary will get their fee.

In the video, Doug indicated the signing services have their own internal “rating system” for signing agents. That means it’s super important to be prompt and professional so you get more gigs through that signing service.

Once you build up a reputation, you’ll have a consistent stream of work.

Through Relationships

The other way to receive signings is directly through loan officers and escrow officers. With this method you receive the full signing fee.

The key to receiving signings through loan officers and escrow officers is by building relationships.

Mark teaches you specifically how to get both kinds of signings in his course.

What Makes for a Successful Mobile Notary?

A successful Mobile Notary is professional and puts building relationships before money. You’ll quickly learn from Mark, the Loan Signing System course, and the LSS family that building relationships with those who work in the real estate industry is very important to being a successful Notary Loan Signing Agent.

Professionalism is another key component for a successful Mobile Notary. Borrowers are spending a lot of money and the companies that hire you expect professional interactions.

The Notary is likely the person who’ll spend the most time with a client during the home purchase, refinance, or HELOC process. The lenders and title companies want to be represented well.

Next Steps

If you’re ready to proceed with this side hustle, your next steps should be:

- Research how to get your Notary commission in your state.

- Verify how loan signings are completed in your state.

- Join a well-rated training program like Loan Signing System.

- Get to work!

If you have any questions, feel free to reach out via Facebook!

About Author

You may also like

-

Financial Planning Through Changing Presidencies: A Personal Journey

-

Four Years Later, You’re Likely Way Better Off Than You Think

-

2025 Tax Brackets: New Ideal Incomes For Workers And Retirees

-

The Surprising Benefits Of Donating To Your Kid’s School

-

Apply Stop Losses To Protect Your Wealth And Quality Of Life