As the economy goes down the tubes thanks to a Fed-induced recession, anger against anybody who is perceived to have more wealth or success will go up. As a result, it’s important to practice Stealth Wealth to stay safe and happy.

I know anger has increased since the bear market began because I run a personal finance website with over 2,500 articles. Lately, there have been a lot more insulting and testy comments on new and old articles, which I won’t share.

There’s a natural tendency for some people to shout on the internet and blame strangers for their financial losses or problems. Blaming others is easier to do than blaming yourself. It may also be gratifying to call people “out of touch” or “elitist” to feel more self-righteous.

As a result, is there any wonder why some rich people want to signal that they’re middle class to the public? Nobody likes to be a part of a minority that gets constantly pelted with insults.

In this post, let’s do a case study on how one person tried to signal Stealth Wealth but didn’t quite succeed. The post is not meant to denigrate the person, but to help us learn how we can be better Stealth Wealth practitioners.

It takes courage to put yourself out there for public consumption, so I applaud her efforts. When you’re still aggressively building wealth and growing credibility, finding the right balance between stealth and status is hard.

A Stealth Wealth Case Study On Poor Signaling

To set the mood, there was a lot of panic during the Silicon Valley Bank bank run. A lot of lives and businesses were at risk of going under. Many people had an interest in having SVB’s deposits above the FDIC limit guaranteed, including myself.

The below tweet exemplifies what was at stake if depositors at Silicon Valley Bank were not made whole by the Federal Government. In a whopping 23-tweet thread, the author argues saving SVB was not about saving the top 1%, but the common person throughout America.

Let’s just review the first tweet out of twenty-three.

At first glance, this is an excellent tweet highlighting how Silicon Valley Bank wasn’t just a bank for techies, entrepreneurs, and VCs in the Bay Area. How could it be?

Lindsey is an Ohio mother of four. Not only does Lindsey do double duty as a mother and startup founder, but she also drives a Honda minivan. In addition, her husband works in manufacturing.

She appears to be a “salt of the Earth” type person who is as far away from being a part of the elite class as possible.

The innuendos from her tweet are:

- Ohio has more down-to-Earth people than people who live in California

- A Honda Odyssey is a middle-class car that’s driven by regular people compared to those who drive Tesla Xs

- Manufacturing is a more noble than investing money and coding

- Being a mother, especially a mother of four, may be superior to those who have no children or fewer children

The strategy of painting yourself and the things you own in a more regular light is good Stealth Wealth practice. You just can’t go too far, otherwise, people will feel slighted. The implication about being superior given she’s a parent can also be very offensive to those who can’t have children or don’t want children.

To make Lindsey’s signaling of Stealth Wealth great, she should have hidden her bio and what her company does. But to obfuscate her bio and her company would then defeat one of the purposes of Twitter: to grow your profile or business.

How Her Stealth Wealth Backfired

To gain status, many of us need to signal to society we have status. This way, we can hopefully build upon our status and become even more successful.

Hence, let’s take a look at Lindsey’s Twitter bio:

Founder/CEO @Strongsuit_co eradicating the mental load so we can all win @ work and @ home; Dreamer, builder, adventurer, feminist, mom of 4; frmr @McKinsey.

Stealth Wealth Mistake #1: Listing A Prestigious Organization In Bio

Based on Lindsey’s bio, she is a superwoman who can do it all. Not only is giving birth and raising four children a difficult feat, but so is getting a job at McKinsey Consulting.

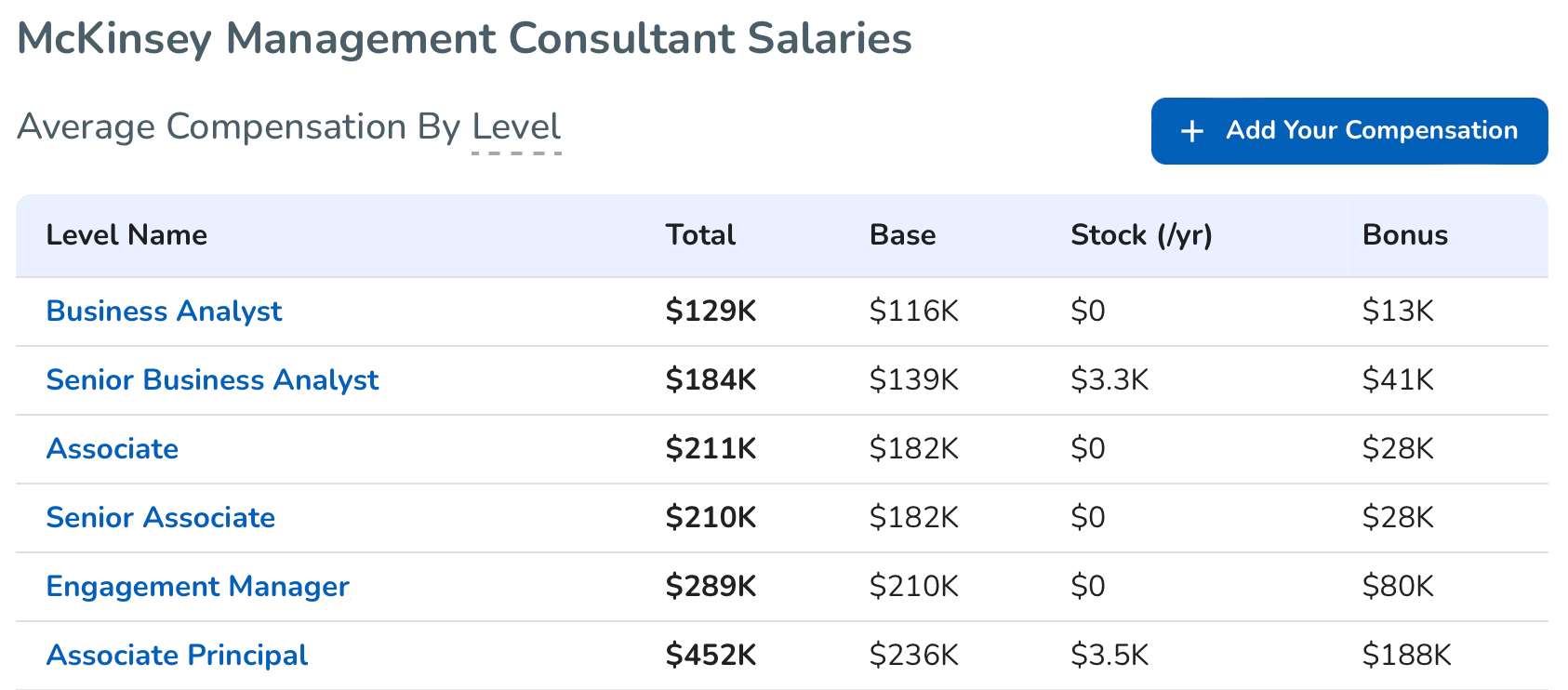

McKinsey is a strategic consulting shop that pays some of the highest salaries post-college. It also has an acceptance rate of about 1%.

With an average compensation of $129,000 a year out of college and $452,000 ten plus years out of college, you can earn a top one percent income for your age group. As a result, listing McKinsey in your bio is not practicing Stealth Wealth, especially if you claim to have ten years of strategy consulting experience.

Listing McKinsey in your bio is a status play. Hence, to be a good Stealth Wealth practitioner, you need to scrub your bio of status markers if you are going to successfully argue yourself as a “commoner.”

Stealth Wealth Mistake #2: Founder Of A Business For Wealthy People

After checking out StrongSuit, it seems like their services provide executive assistants to busy families. A StrongSuit assistant can help you sign your kid up for soccer, remind you when is teacher appreciation day, and when to book a vacation.

Essentially, StrongSuit helps reduce the mental load all parents experience by doing some of these daily family tasks. As a parent to a couple of young kids, I get it. Although I’d never pay someone to remind me to take my daughter to swim class. It’s one of the events I look forward to the most each week!

Paying $500 a month for a family assistant is a luxury that perhaps only the mass affluent or rich can afford. As a result, Lindsey’s plea for help does not support her argument of bailing out the common person.

Check out the video yourself.

Stealth Wealth Mistake #3: Saying You’re A Private School Alumni

Her final stealth wealth mistake is highlighting being a graduate of DePauw University and Duke University in her company bio. Although it is perfectly normal to list your education to build credibility for your business, it runs contrary when trying to be Stealth Wealth.

You’ve got to be consistent with your signaling to make a more powerful argument.

Expensive Undergraduate Degree

The annual tuition at DePauw University is $56,030. The university estimates the average annual cost to attend the university is $71,920. This is an amount very few middle-class families can afford, even if most don’t pay full sticker.

What’s more, DePauw University has an acceptance rate of about 65%, which makes attending the school an even greater luxury. Only the rich or those with generous grants would be willing to pay $56,030 in tuition alone to go to a school ranked #45 on U.S. News & World Report’s National Liberal Arts Colleges (not the main list). After all, you can pay the same to go to any Ivy League university.

One of the reasons why I attended The College of William & Mary was because I could afford in-state tuition. In the event I couldn’t find a job that required a college degree, I could pay back my parents with a minimum-wage job at McDonald’s.

My parents were government workers, so I had a good idea of what they made. It didn’t feel right to attend a private university, unless, maybe the university was ranked in the top 10.

But I didn’t even apply to the top private universities because I simply wasn’t smart enough. Applying felt like I’d be throwing away application fee money. When you come from a middle-class household, application fees can act as a barrier to even try.

An Even More Expensive Graduate Degree

Duke University is a top 20 MBA program that costs $75,000 a year in tuition. Duke estimates its MBA students will need to spend $106,962 a year to attend Fuqua for two years. Its acceptance rate is about 24%.

Forgoing two years of income and paying six-figures a year to get an MBA is a steep price to pay. But luckily, Linsey was making multiple six-figures at McKinsey to be able to afford the tuition.

Remember, the average income for an Engagement Manager is $289,000 and $452,000 for an Associate Principal. And in her tweet thread, Lindsey said she made the same as her husband.

It was smart not to mention her husband also makes multiple six-figures a year. But the average person can deduce that means they once had a household income of over $500,000 a year in Ohio. That’s like making over $1 million if they lived in New York City or San Francisco.

I also have an MBA, but from UC Berkeley. However, I didn’t go the full-time route because I couldn’t afford to give up two years of my career and pay ~$28,000 a year in tuition.

Instead, I went the part-time route and my employer paid for 80% of my tuition. I could have asked for the remaining 20% reimbursement, but we were in the middle of multiple rounds of layoffs. My cost-benefit analysis concluded it was more important to keep my seat.

Carefully Signal The Image You Want

Showcase your pedigree if you’re trying to build a company, sell a product, or sell yourself. Be proud of the places you’ve worked and the schools you’ve attended. You’ve earned the right to tell the world about your background.

However, if you’re going to argue you’re a regular middle-class person who needs to be saved, then you may want to scrub your biography of status and wealth markers. If you don’t, you may receive a lot of backlash.

Personally, I think what Lindsey is doing is incredible. I salute all entrepreneurs and working parents.

Taking a leap of faith is not easy as it requires tremendous courage and planning to leave a well-paying job behind. Then for her to also take care of four children is incomprehensible to me as a struggling dad of only two young children.

It’s clear Lindsey is trying to solve a problem that only grew bigger during the pandemic.

The Right Balance Of Stealth Wealth And Status

Finding the right balance of stealth wealth and status is always going to be tricky.

My recommendation is to be flexible in your signaling. If you need credibility, then highlight your status markers. If you want peace, hide them.

From 2012 to 2019, I was happy being a nobody. I just did my own thing. Instead of fame, all I wanted was to conservatively grow my wealth to stay free.

However, once we got rejected by six-out-of-seven preschools between 2017 – 2019, I realized I needed more status for my kids. In contrast, my friend got into all four of the preschools they applied to, even though two have a “lottery system” for the sake of equity.

Then when I published my personal finance book, Buy This, Not That in 2022, I needed to highlight my achievements in order to get interviewed on podcasts and TV. For three months, the book marketing felt unnatural. But it got me out of my comfort zone and reaffirmed my desire to stay low key.

Now I’m happy being a nobody again as I focus on family, sports, and writing my next book. My kids have gotten into good schools and there’s nothing I need to sell to survive. Perfect!

I still need to share certain financial figures to be a credible personal finance writer. However, as time passes, I’ve become less inclined to share as much. My figures don’t matter. Yours do if you’re still on your path to financial freedom.

Reader Questions and Suggestions

What are some Stealth Wealth signaling mistakes you see? What’s the best strategy to come across as credible, but not seem boastful? How have you been able to hide your wealth or intelligence to keep more haters at bay?

Join 55,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

<!–

–>

About Author

You may also like

-

Key Factors To Consider Before Changing Health Insurance Plans

-

Return On Effort (ROE) Is Your Key To Unlocking A Better Life

-

A Net Worth Equal To 25X Expenses Is Not Enough To Retire Early

-

The 4% Rule: Clearing Up Misconceptions With Its Creator Bill Bengen

-

Uncover Your True Investment Risk Profile: It’s Not What You Think